When a beloved public figure leaves us, there's often a natural curiosity about their life's work and, quite frankly, what happens to their belongings and financial legacy. Alan Thicke, a familiar face from television screens for decades, left a significant mark on the entertainment world. So, it's quite natural, isn't it, to wonder, "Who inherited Alan Thicke's money?" The idea of inheritance itself carries a lot of meaning. It's about receiving something, perhaps a right or a title, from an ancestor after their passing, a process often guided by the law of the land.

Inheritance isn't always about money or property, though that's a big part of it. Sometimes, people receive particular characteristics from their parents through the genes, like a certain hair color or even a way of looking at things. In a way, you could say we all inherit something, whether it's a family trait or a piece of a legacy from those who came before us. It’s about what gets handed down, either through biology or through legal arrangements made to ensure things go where they're meant to.

Alan Thicke's situation, however, became a bit more public than some. After his sudden passing in December 2016, questions quickly surfaced about his estate. It wasn't just about who got what, but also about the process, the family dynamics, and the legal steps involved in distributing his assets. This sort of thing, you know, can be quite complex for any family, especially when a public figure is involved.

- Sanders Bbq Supply Co

- Aliz Hotel Times Square

- Lawn On D Boston

- Motw Coffee And Pastries

- Radio Coffee And Beer

Table of Contents

- Alan Thicke: A Brief Life Story

- The Meaning of Inheritance: A Quick Look

- Alan Thicke's Passing and Immediate Aftermath

- Who Inherited Alan Thicke's Money? The Estate Plan Revealed

- The Family's Side of the Story: Disputes and Resolutions

- Lessons from Alan Thicke's Estate

- Frequently Asked Questions About Alan Thicke's Estate

- Staying Informed About Celebrity Estates

Alan Thicke: A Brief Life Story

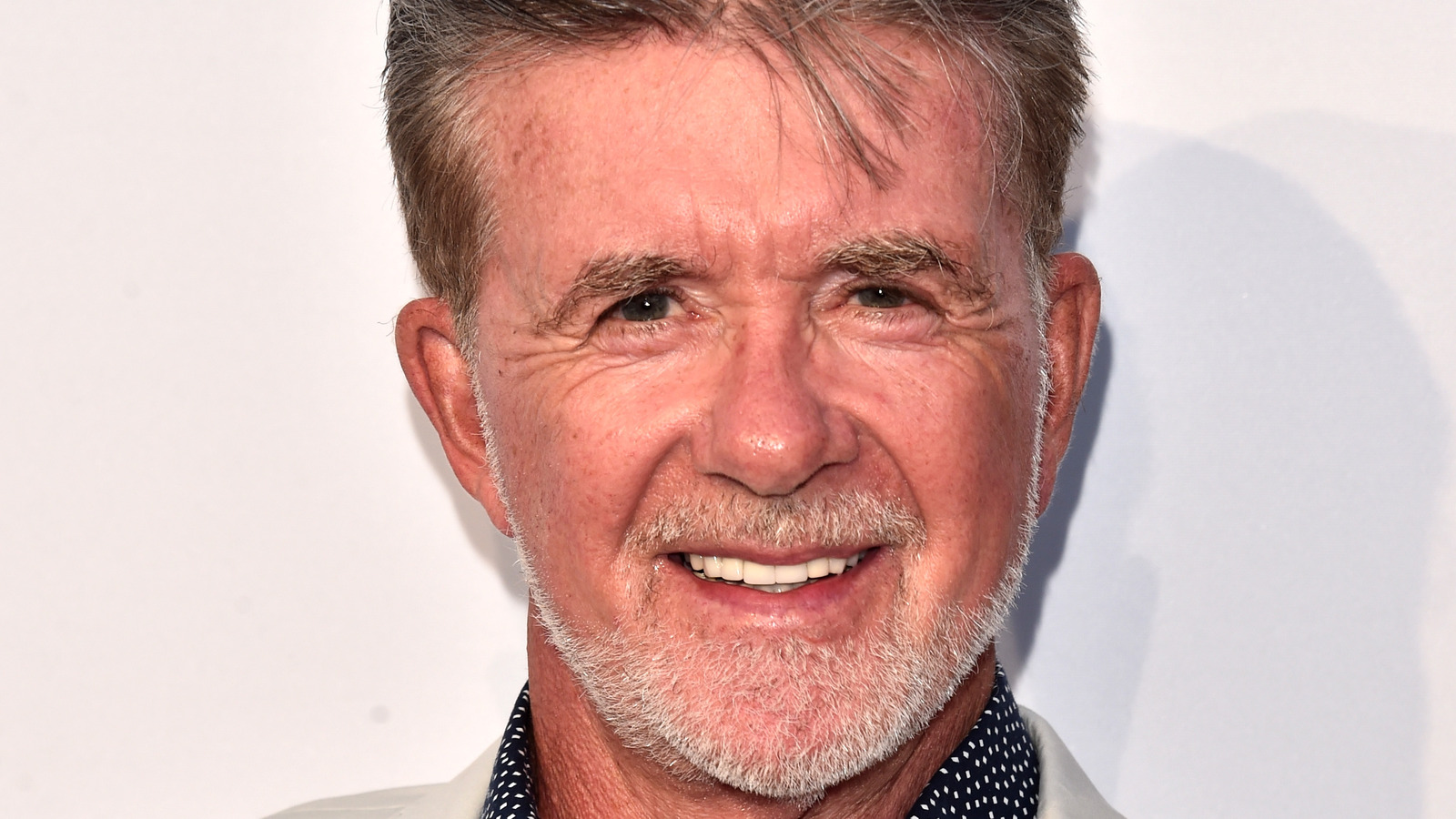

Alan Thicke, a truly versatile personality, made his name in many areas of show business. Born in Kirkland Lake, Ontario, Canada, he began his career behind the scenes, writing for television. He then moved into hosting talk shows and game shows, showcasing his quick wit and charming demeanor. His most famous role, without a doubt, was Dr. Jason Seaver on the popular sitcom "Growing Pains," which ran from 1985 to 1992. This role cemented his place in the hearts of many viewers across generations, really.

Beyond acting, Alan Thicke was also a talented songwriter, composing theme songs for various television shows, including "Diff'rent Strokes" and "The Facts of Life." He was, you know, a true multi-hyphenate in the entertainment field. His personal life saw him marry three times and become a father to three sons. His passing, at the age of 69, was a shock to many, leaving behind a family and a significant body of work.

Personal Details and Bio Data

| Full Name | Alan Willis Jeffrey Thicke |

| Date of Birth | March 10, 1947 |

| Place of Birth | Kirkland Lake, Ontario, Canada |

| Date of Passing | December 13, 2016 |

| Spouses | Gloria Loring (m. 1970; div. 1984), Kristy Swanson (m. 1994; div. 1999), Tanya Callau (m. 2005) |

| Children | Brennan Thicke, Robin Thicke, Carter Thicke |

| Occupation | Actor, Songwriter, Talk Show Host |

| Known For | Dr. Jason Seaver on "Growing Pains" |

The Meaning of Inheritance: A Quick Look

Before we look at Alan Thicke's specific situation, it's helpful to understand what inheritance generally means. As we discussed earlier, to inherit means to receive something from an ancestor, usually a right or title that passes down by law after someone dies. This could be property, money, or other valuable items. It's how assets are transferred from one generation to the next, a very old concept, actually.

- Leroy And Lewis Bbq

- Jet Avatar The Last Airbender

- The Tides Estate North Haledon New Jersey

- Real Chance Of Love

- Hunter S Thompson Daily Routine

The term "inherited" also refers to characteristics or traits that are passed down through a family, like those red hairs or a certain stubbornness you might get from your parents through genes. But in a legal sense, it's about what is received from someone who has died, often under the terms of a will or a trust. All her children, for example, might stand to inherit equally, depending on the wishes of the person who passed away. It really refers to the transfer of property, rights, or obligations from preceding generations, either through natural biological processes or legal procedures, you know.

When someone passes away, their estate, which includes all their possessions and financial holdings, needs to be handled. This process is called probate if there's a will, or administration if there isn't one. The goal is to make sure everything goes to the rightful recipients, as intended by the person who passed away, or as dictated by the law. An inherited situation, like a family business, could also mean taking on responsibilities or problems that existed before, which is a bit different from just receiving assets, isn't it?

Alan Thicke's Passing and Immediate Aftermath

Alan Thicke's passing on December 13, 2016, came as a sudden and heartbreaking event. He suffered an aortic dissection while playing hockey with his youngest son, Carter. The news sent shockwaves through the entertainment community and among his many fans. People remembered him for his warm presence and his role as a quintessential TV dad. It was a very sad time, really.

In the days and weeks that followed, tributes poured in from colleagues, friends, and family members. While the world mourned a beloved figure, his family began the difficult process of dealing with their personal loss and, as is often the case, the practical matters of his estate. This period is, you know, a very tender time for anyone, let alone a family in the public eye. Questions about his will and how his assets would be divided started to surface, as they often do when a prominent person passes.

It quickly became clear that Alan Thicke had taken steps to plan for his estate. He had a trust in place, which is a common way for people to manage their assets and ensure they are distributed according to their wishes without going through a lengthy public probate process. However, even with a trust, disagreements can sometimes arise, especially when family members have different ideas about what was intended or what is fair. This is, apparently, what happened in his family's situation, too.

Who Inherited Alan Thicke's Money? The Estate Plan Revealed

So, the big question: Who inherited Alan Thicke's money? According to court documents filed in May 2017, several months after his passing, Alan Thicke had established a living trust. This trust, created in 1988 and updated over the years, was designed to manage his assets and provide for his family. The trust was intended to avoid the public and often lengthy probate process, keeping the details of his estate more private. It's a fairly common tool for estate planning, you know.

His estate, which included a California ranch, various other properties, and personal wealth, was set to be divided among his three sons – Brennan, Robin, and Carter – and his third wife, Tanya Callau. The trust outlined specific provisions for each beneficiary, aiming to provide for them after his passing. This setup, you see, is typical for someone with a family and a desire to ensure everyone is cared for.

The total value of his estate was reported to be around $40 million at the time of his passing, though these figures can fluctuate with asset valuations. The trust detailed how his assets would be managed and distributed, including things like intellectual property rights, real estate, and financial accounts. It was, more or less, a comprehensive plan to hand down his wealth and legacy to his loved ones, just as the meaning of inherit suggests receiving property under a will or succession.

The Primary Beneficiaries

The primary beneficiaries of Alan Thicke's trust were indeed his three sons and his wife, Tanya Callau. His sons, Brennan and Robin, from his first marriage, and Carter, his youngest son from his second marriage, were designated to receive equal shares of certain assets. This included, for instance, a significant portion of his personal property and intellectual property rights, like royalties from his songwriting and acting roles. This ensures, in a way, that his creative legacy continues to benefit his children.

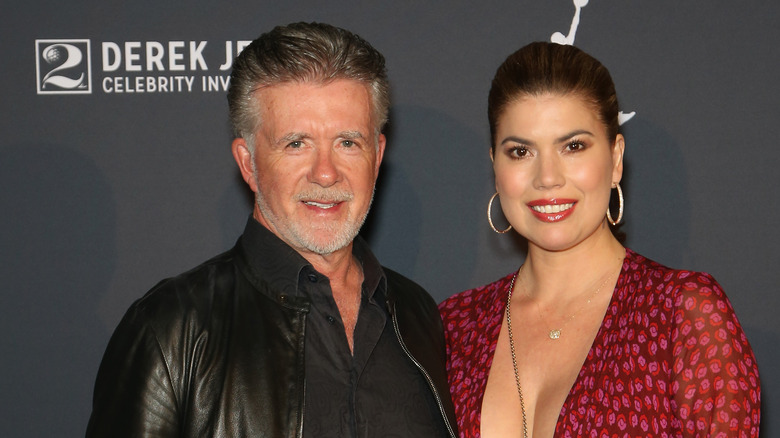

Tanya Callau, his widow, was also a key beneficiary. The trust provided for her through various means, including a share of his personal property, the right to live at the family's Carpinteria ranch, and a life insurance policy. This arrangement is quite common, you know, to ensure a surviving spouse is well-provided for and can maintain their living situation. The trust aimed to provide financial security for her, as well as for his children, which is, honestly, what most people want for their families.

The division of assets aimed to be fair, reflecting his relationships with each family member. It’s about ensuring that everyone who stood to inherit received their designated portion, as if from one's predecessors, a concept very much in line with how inherit is understood. The trust, in essence, laid out a detailed roadmap for the distribution of his financial life's work, trying to prevent disputes, though sometimes, you know, things don't always go as smoothly as planned.

Understanding the Trust

A trust, in simple terms, is a legal arrangement where a person (the "settlor" or "grantor," in this case, Alan Thicke) gives control of their assets to another person or entity (the "trustee") for the benefit of a third party (the "beneficiaries"). The trustee manages these assets according to the instructions laid out in the trust document. This setup allows assets to be distributed outside of the public probate court, offering more privacy and often a quicker distribution process. It's a very useful tool for estate planning, really.

Alan Thicke's trust, as reported, included provisions for the distribution of his real estate, personal belongings, and intellectual property. For example, the Carpinteria ranch, a significant asset, was placed into the trust. Tanya Callau was given the right to live there, but the property itself was ultimately intended for Carter, his youngest son, after Tanya's passing. This kind of arrangement, you see, is often used to balance the needs of a surviving spouse with the long-term wishes for children.

The trust also contained provisions for the income generated from his creative works, ensuring that his sons would benefit from his ongoing royalties. This means that even after his passing, his artistic contributions continue to provide for his family, a powerful aspect of his legacy. Such detailed planning, you know, is quite common for individuals with diverse assets and multiple beneficiaries, aiming to avoid future complications and provide clear instructions for those who stand to inherit.

The Family's Side of the Story: Disputes and Resolutions

Despite Alan Thicke's efforts to create a clear estate plan through his trust, a disagreement did arise among his family members. This isn't entirely uncommon, even with well-thought-out plans. When emotions are high and significant assets are involved, different interpretations or concerns can surface. It's a human thing, really, to have questions during such a difficult time.

In May 2017, a few months after his passing, Alan Thicke's sons, Brennan and Robin, filed a petition in Los Angeles Superior Court. They sought to confirm the validity of their father's trust and to get court guidance on its administration. Their stated reason was to prevent any potential claims by Tanya Callau that might challenge the trust's provisions or the prenuptial agreement she had signed. This action, you know, was a step to ensure their father's wishes were carried out as he intended.

The sons expressed concern that Tanya was making demands that went beyond the terms of the trust and her prenuptial agreement. They wanted the court to affirm that the trust was indeed valid and that its terms should be followed. This kind of legal action, you see, is sometimes necessary to get clarity and to protect the integrity of an estate plan, especially when there are differing views among the beneficiaries. It's about making sure everything is handled correctly, more or less.

The Sons' Concerns

Brennan and Robin Thicke's petition outlined their concerns quite clearly. They claimed that Tanya Callau was asserting that the prenuptial agreement she signed was invalid and that she was entitled to a larger share of the estate than the trust provided. The sons argued that their father's trust, which was updated in 2016, specifically provided for Tanya, including the Carpinteria ranch, other property, and a life insurance policy, and that these provisions were consistent with the prenuptial agreement. They felt, you know, that their father had made his wishes very plain.

Their petition stated that Tanya had apparently threatened to challenge the trust and the prenuptial agreement, which could, they feared, cause significant legal expenses and delay the distribution of assets to all beneficiaries. They sought court intervention to, in essence, uphold their father's final wishes and prevent what they saw as an attempt to alter the agreed-upon distribution. This kind of situation can be very stressful for a family, you know, especially when grieving.

The sons' goal was to ensure that the assets were distributed according to the terms Alan Thicke had carefully laid out. They wanted to avoid a prolonged legal battle that could drain the estate and create more animosity within the family. It was, in a way, an effort to protect their father's legacy and ensure that his intentions for his children and wife were respected. They were, you know, simply trying to carry out what they believed was their father's will, as they stood to inherit from him.

Tanya Callau's Perspective

Tanya Callau, Alan Thicke's widow, also had her side of the story. While the sons' petition painted a picture of her challenging the trust, her representatives stated that she was merely seeking clarity and reassurance about her financial future. She expressed feeling uncertain about how the trust would operate and how it would provide for her long-term needs, especially given the suddenness of Alan's passing. It's understandable, isn't it, for someone in her position to have questions?

Her legal team suggested that the petition filed by the sons was, perhaps, an overreaction and that Tanya was not trying to "overturn" the trust. Instead, they indicated she was looking for confirmation and understanding of the trust's provisions, particularly regarding her living situation at the ranch and her ongoing financial support. This is, in some respects, a common concern for surviving spouses, especially when the estate plan is complex.

Ultimately, Tanya's goal was to ensure she was adequately provided for, as she believed Alan would have wanted. While the sons focused on upholding the strict terms of the trust, Tanya's concerns likely centered on practical day-to-day living and her security. This kind of difference in perspective, you know, often leads to misunderstandings that can then become legal disputes, even when everyone cares about the person who passed away.

Finding Common Ground

Fortunately, the dispute between Alan Thicke's sons and his widow did not escalate into a lengthy public court battle. Reports indicated that the family eventually reached an agreement outside of court, resolving their differences. This resolution meant that the terms of Alan Thicke's trust would, more or less, be honored, with adjustments or clarifications made to satisfy all parties involved. It was, truly, a positive outcome for everyone.

The exact details of the settlement were not made public, as is often the case with such agreements. However, the fact that a resolution was reached suggests that all parties were willing to compromise and find a way forward that respected Alan Thicke's wishes while also addressing the concerns of his family members. This kind of outcome is, you know, what many families hope for when dealing with an estate, avoiding prolonged conflict.

This resolution allowed the family to move forward and focus on preserving Alan Thicke's memory and legacy rather than being consumed by legal wrangling. It shows that even when disagreements arise, open communication and a willingness to find a middle ground can lead to a peaceful settlement. It's a reminder that, sometimes, the best way to honor someone who has passed is to find harmony among those they left behind, which is, you know, a very human thing to do.

- House Of Biryani And Kebabs

- Outrigger Reef Oahu Hawaii

- Jet Avatar The Last Airbender

- Brier Creek Country Club

- Gotham Gym New York

Detail Author:

- Name : Manley Cummings

- Username : mwolf

- Email : nbartell@dibbert.org

- Birthdate : 1988-06-11

- Address : 82267 Gerhold Wall East Godfrey, MI 10845-4996

- Phone : (707) 528-2645

- Company : Kessler-Weissnat

- Job : Cartoonist

- Bio : Sit maxime quidem hic assumenda. Mollitia aspernatur veniam adipisci. Dignissimos et saepe autem sint.

Socials

tiktok:

- url : https://tiktok.com/@hilma_official

- username : hilma_official

- bio : Eos et dicta possimus unde est praesentium nemo.

- followers : 5878

- following : 1893

twitter:

- url : https://twitter.com/hilma.murphy

- username : hilma.murphy

- bio : At rerum repellat non expedita vel autem et suscipit. Optio maxime voluptas sit doloribus dolores. Quis accusantium porro ut vero ratione voluptates.

- followers : 1027

- following : 1363

linkedin:

- url : https://linkedin.com/in/hilma4301

- username : hilma4301

- bio : Repellendus dolorum non consectetur doloribus.

- followers : 3223

- following : 2408