Understanding who holds the biggest pieces of a company, like Mara, is often a very important point of interest for many people. It's a bit like trying to figure out which lake is the largest in the world; you might think about surface area, or maybe how deep it goes. Similarly, when we talk about who owns the most of a company, we're really looking at who has the greatest stake, which can tell us a lot about its direction and how it operates. This kind of information, you know, really helps paint a clearer picture of a company's foundation and its potential path forward.

It's interesting, isn't it, how the idea of "largest" can sometimes be a little nuanced? For instance, when you're looking for the biggest number in a list, you're seeking the one with the highest value. In the business world, a company's "largest shareholders" are those who possess the greatest individual or institutional holdings of its stock. This doesn't always mean they own more than half, which is what we'd call a majority, but they certainly hold a significant portion, perhaps the single largest part, which is a rather important distinction to make.

So, why does any of this matter to you, or to anyone curious about a company like Mara? Well, knowing who the big owners are can shed light on a company's stability, its strategic alliances, and even its future plans. It’s about more than just numbers; it's about influence and direction, and that, is that, a pretty big deal for anyone watching the market or simply trying to learn more about a particular business. We'll delve into what it means to be a large shareholder and how such stakes can shape a company's story.

- The Violet Hour Chicago

- Honolulu Board Of Water Supply

- The Clock Coffee Shop

- Wild Child St Pete

- Teo Briones Movies And Tv Shows

Table of Contents

- Grasping the Idea of "Largest Shareholders"

- How Significant Ownership Takes Shape

- Finding Out About Major Shareholdings for a Company Like Mara

- The Influence of Significant Investors

- Common Questions About Big Company Owners

- Reflecting on the Significance of Ownership

Grasping the Idea of "Largest Shareholders"

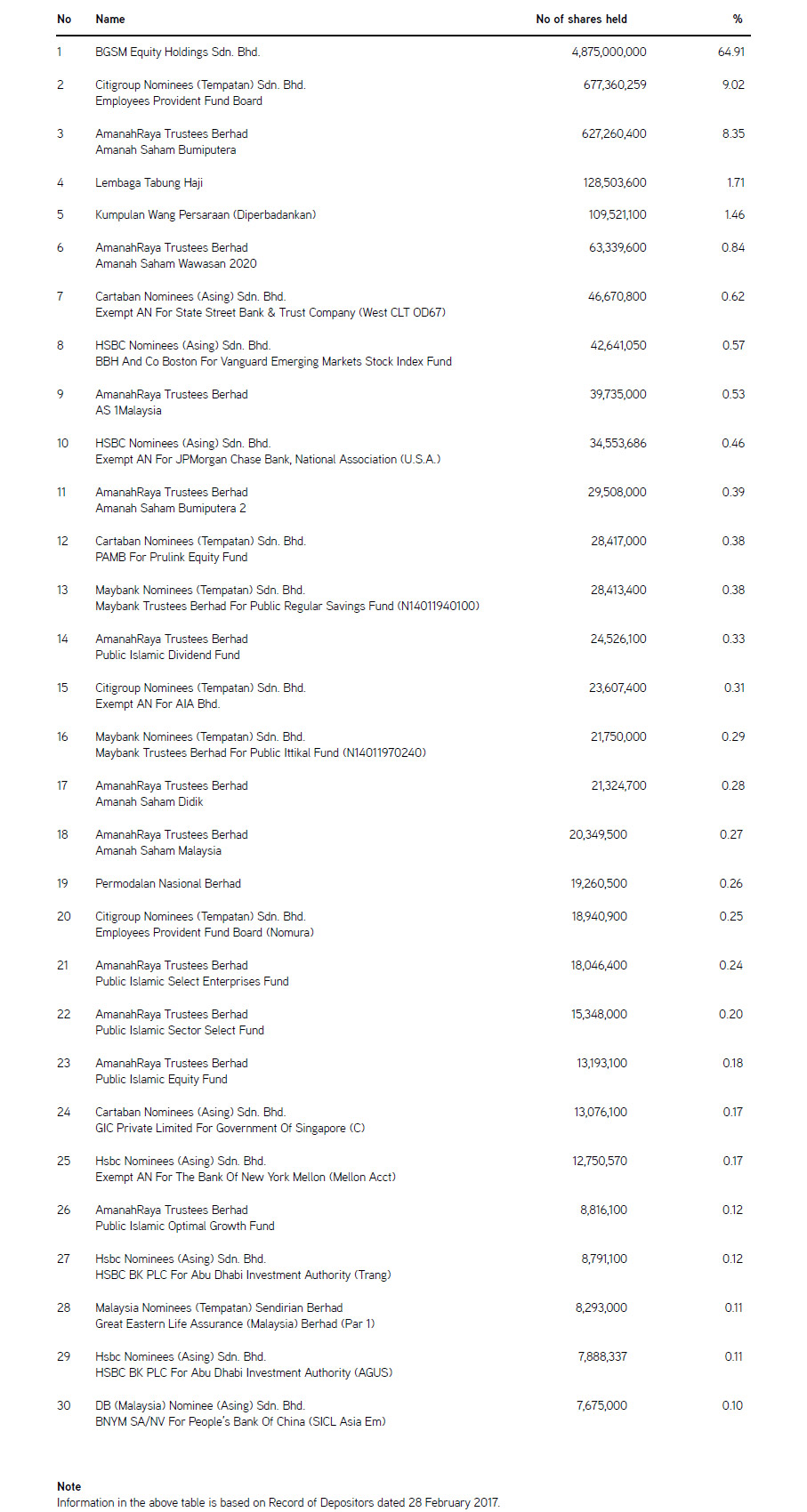

When we talk about the "largest shareholders" of a company, we are really focusing on those entities or individuals who possess the most shares compared to others. This concept is pretty similar to finding the greatest number in a list or identifying the largest group within a population, as we might consider with adult Americans who never married, which, in some years, accounted for a significant portion, perhaps around 15% then 20% of the total. It’s about identifying the biggest piece of the pie, so to speak, even if that piece isn't the whole pie itself.

What "Largest" Truly Means in Ownership

The term "largest shareholder" points to the single biggest holder of a company's stock. It's important to understand that "largest" does not always mean "majority." For example, if a company has three main owners, and one holds 40% of the shares, while the other two each hold 30%, that 40% holder is certainly the largest, but they do not have a majority. A majority would be more than 50%, giving them ultimate control over most decisions. This distinction is very important, as it shapes the degree of influence a large shareholder might actually have over a company's operations and strategic moves, a point that is, you know, often overlooked.

Think of it this way: dinner is often considered the largest meal of the day, but that doesn't mean it's the *only* meal, or that it provides *all* your daily nutrition. It just means it's the most substantial one. Similarly, the largest shareholder holds the most substantial block of shares, but other shareholders, even smaller ones, still play a role. The research so far indicates that both terms, "largest" and "greatest," are used in similar contexts when talking about numbers or proportions, and that holds true for share ownership too, generally speaking.

- Buenos Dias Feliz Domingo

- Chappell Roan Album Cover

- Tornado Warning Issued For Branch County Thunderstorm

- Rock N Roll It

- Fat Bastard Austin Powers

The largest share of anything, whether it's a cost estimate for long-term projects accounting for 47% of a region's total cost, or a significant block of company shares, points to the biggest single component. This isn't necessarily about absolute control, but about having the greatest single impact. So, when we ask about Mara's largest shareholders, we're looking for that single biggest holder, the one with the most substantial stake, which is a key piece of information for anyone interested in the company's structure.

Why Knowing Big Owners Matters

Knowing who holds the biggest pieces of a company's ownership puzzle is quite significant for a few reasons. For one thing, these large shareholders often have a considerable voice in the company's decisions, influencing everything from leadership changes to major business strategies. Their interests can really shape the direction a company takes, for better or worse. It’s almost like understanding the largest snake to ever live, discovered in an Indian mine, tells us something profound about ancient ecosystems; similarly, understanding a company's largest owners tells us a lot about its corporate environment.

Furthermore, the identity of a company's largest shareholders can also signal its stability and future prospects. If a company has a few very large, stable institutional investors, it might suggest a certain level of confidence in its long-term potential. On the other hand, if ownership is constantly shifting among many different large entities, it could hint at volatility or changing strategic directions. This kind of insight is, you know, pretty valuable for anyone trying to get a feel for a company's pulse in today's rather active market.

It also matters for transparency and accountability. In many cases, particularly for publicly traded companies, information about large shareholdings is publicly available, allowing investors, analysts, and the general public to see who truly has a vested interest. This openness helps foster trust and provides a clearer picture of who stands to gain or lose most from a company's performance. So, in some respects, it's about shining a light on where the real power might lie within the company structure.

How Significant Ownership Takes Shape

The way significant ownership takes shape within a company can be quite varied. It's not always just one person holding a huge chunk of shares. Sometimes, it's a collection of related entities, or perhaps different types of investors, each with their own reasons for holding a large stake. This diversity in ownership can make the picture of "largest shareholders" a little more complex than simply pointing to a single name, which is something worth considering.

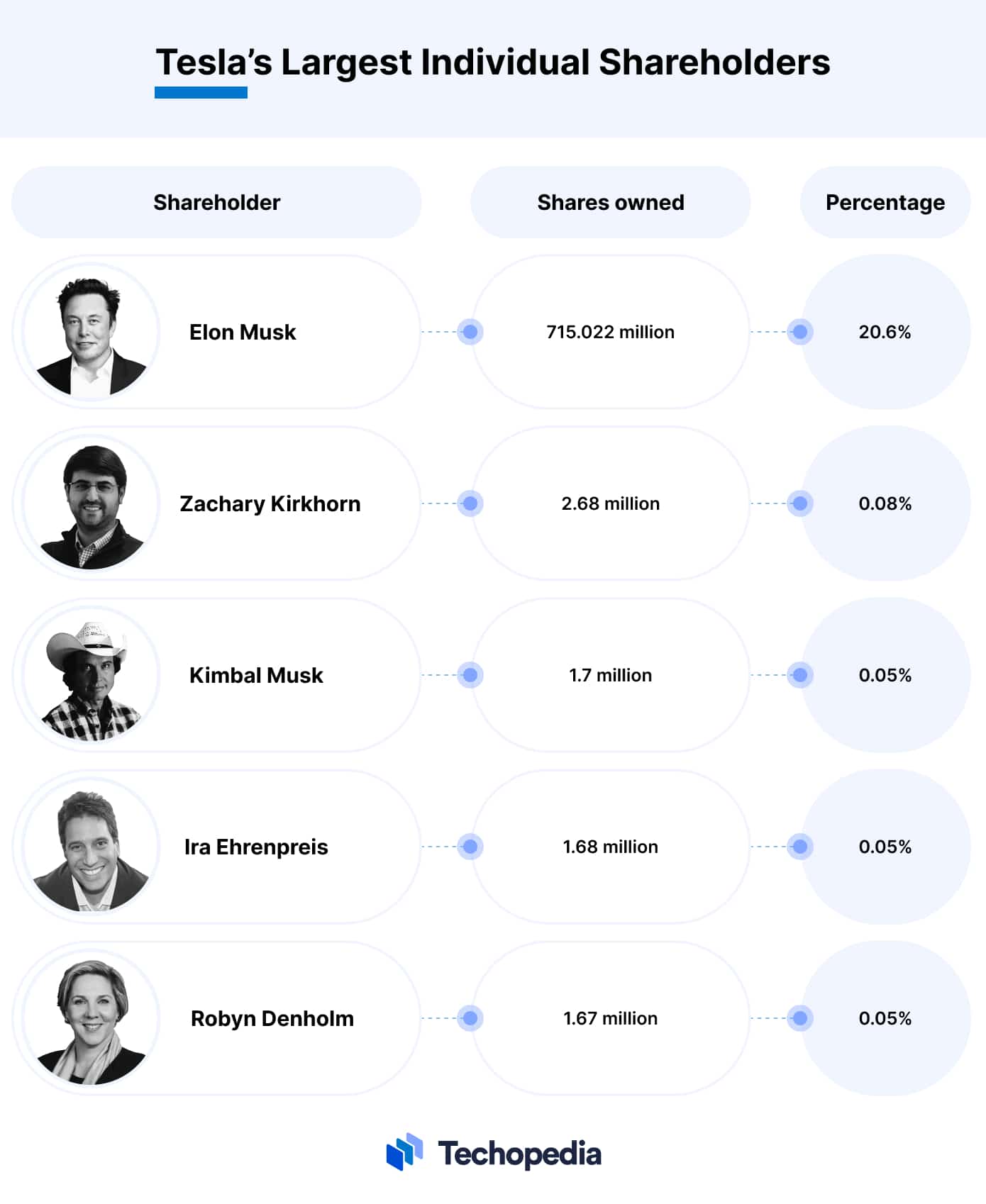

Different Kinds of Big Owners

When we talk about big owners, we're usually looking at a few common types. You might find institutional investors, like mutual funds, pension funds, or hedge funds, which manage vast sums of money on behalf of many clients. These institutions often buy large blocks of shares in companies they believe will perform well. Then there are corporate investors, where another company might own a significant stake, perhaps for strategic reasons or as part of a joint venture. And, of course, there are individual investors, often founders or early employees, who retain a very substantial portion of the company's shares. Each type brings its own perspective and goals to the table, which can certainly influence the company's overall trajectory.

Sometimes, a very large shareholder might be a family trust or a holding company, created specifically to manage the wealth and interests of a founding family. These kinds of owners often have a long-term view, deeply invested in the company's heritage and future. It's a bit like how certain cultural practices determine whether dinner is eaten at noon or in the evening; the background of the owner can influence their approach to the company. So, understanding the *type* of large shareholder can provide even deeper insights into the company's potential actions and priorities, which is, honestly, pretty fascinating.

Also, it's worth noting that the "largest" shareholder might change over time. Markets are dynamic, and large blocks of shares can be bought or sold. This constant movement means that the list of top owners isn't set in stone; it's a living, breathing aspect of a company's financial structure. This fluidity is just part of the market, really, and it means keeping up with who holds the biggest stakes is an ongoing process for those who want to stay informed.

The Power of a Large Share

A large shareholding, even if it's not a majority, carries considerable weight. As mentioned earlier, if one shareholder holds 40% of a company's stock, and two others hold 30% each, the 40% holder is the largest, but not the majority. However, that 40% still gives them a powerful voice, perhaps enough to block certain actions or push through others, especially if they can garner support from even a small number of other shareholders. This kind of influence is not to be underestimated, and it often plays a very central role in corporate governance.

The ability of a large shareholder to influence board elections is another key aspect of their power. By controlling a significant block of votes, they can often ensure that directors who align with their interests are appointed. This means that even without a majority, they can shape the leadership and strategic direction of the company through their representation on the board. This is a very practical way that a large share translates into real power, and it’s something companies and other investors pay close attention to, as a matter of fact.

Furthermore, having a substantial stake means that the financial interests of the largest shareholder are deeply tied to the company's performance. They have a very strong incentive to see the company succeed, which often aligns their goals with those of other shareholders. This shared interest can be a powerful force for growth and stability, though sometimes the interests of a large shareholder might diverge from those of smaller, individual investors. It's a delicate balance, you know, and one that is constantly being navigated in the business world.

Finding Out About Major Shareholdings for a Company Like Mara

Discovering who the largest shareholders of a company are generally involves looking at publicly available information, especially for companies that are traded on stock exchanges. It's not always as simple as asking a question that was asked six years and nine months ago and modified six years and nine months ago, but the information is often out there for those who know where to look. While "My text" does not contain specific financial data about Mara's shareholders, we can discuss the typical avenues one would explore to uncover this kind of information.

Public Information and Its Limits

For publicly traded companies, regulations often require them to disclose their significant shareholders. This is done to ensure transparency and to provide a clear picture of ownership structure to the market. However, there are limits to this. Sometimes, shares are held through various nominee accounts or trusts, making it a bit harder to trace the ultimate beneficial owner. Also, private companies, by their very nature, are not usually required to disclose their ownership information publicly, so finding their largest shareholders can be much more challenging, if not impossible for the general public. So, you know, it really depends on the type of company we are talking about.

The information provided in "My text" talks about "the largest share of the region's cost estimate total," which gives us a conceptual framework for understanding "largest" in terms of proportion. When applying this to shareholders, it means we're looking for the biggest single percentage held by an entity. This information, when available, is typically found in official filings, which are designed to be accessible to the public. It's about finding that key percentage that represents the biggest piece of the ownership pie, a bit like identifying the largest group in a population, as was mentioned with adult Americans who never married, which can be quite telling.

Looking at Regulatory Filings

For companies listed on stock exchanges, one of the primary places to find information about major shareholders is through regulatory filings. In the United States, for example, the Securities and Exchange Commission (SEC) requires companies to file various reports, such as 10-K annual reports and proxy statements (DEF 14A), which often list the beneficial owners of more than 5% of a company's stock. These documents are publicly accessible through the SEC's EDGAR database. Other countries have similar regulatory bodies and filing requirements, which, you know, makes this kind of research pretty standardized globally.

These filings are really valuable because they provide a formal, verified record of who holds significant stakes. They detail not only the names of the largest shareholders but also the number of shares they own and their percentage of the total outstanding shares. This allows for a clear comparison, helping to determine who holds the "largest" stake, just as one might compare numbers in an array to find the biggest one. It’s a very direct way to get the facts, straight from the source, and it's something that is, frankly, essential for serious analysis.

It's important to review the most recent filings, as ownership can change over time. A company's shareholder base is not static, and what was true a year ago might not be true today. So, keeping an eye on these updates is pretty crucial for anyone tracking significant ownership, as a matter of fact. These documents are designed to provide transparency, giving interested parties a clear picture of who holds the most sway within a company, and that, is that, a really helpful resource.

Financial News and Reports

Another excellent source for identifying major shareholders is reputable financial news outlets and specialized market data providers. These platforms often aggregate and analyze information from regulatory filings, making it easier for the average person to access and understand. They might publish articles or reports specifically detailing a company's top investors, sometimes even providing context on why certain entities hold large stakes. This can be a more digestible way to get the information than sifting through raw legal documents, you know, for many people.

Investment research firms also frequently publish reports that include detailed ownership breakdowns. These reports can offer deeper insights into the motivations of large shareholders and the potential impact of their holdings on the company's strategy. While some of these services might require a subscription, free summaries or news articles often cite their findings, providing valuable clues. It’s about leveraging the work of others who specialize in this kind of data collection and analysis, which can save a lot of time and effort, naturally.

Moreover, company press releases and investor relations sections on their official websites can sometimes offer glimpses into their major investors, especially if a large institutional investor has recently taken a significant position or divested a large stake. Companies often highlight these developments as part of their communications strategy. So, checking these official channels can also be a good step in piecing together the ownership puzzle, and it's a very direct way to hear about changes from the company itself.

The Influence of Significant Investors

The presence of large shareholders can have a profound impact on a company's trajectory. These aren't just passive investors; they often represent a powerful force that can shape key decisions and strategic directions. Their influence stems not just from the sheer number of shares they hold, but also from their ability to organize

- Temeku Discount Cinemas Temecula

- Hotel Glance In Florence Firenze

- Rock N Roll It

- Something In The Water 2024

- Hansen Dam Aquatic Center

Detail Author:

- Name : Mrs. Dessie Blick

- Username : annie.stroman

- Email : tyson87@stokes.net

- Birthdate : 1994-05-05

- Address : 4732 Deshaun Divide Port Malloryberg, GA 72306-2224

- Phone : +1-559-228-8865

- Company : Ullrich-Gottlieb

- Job : Crane and Tower Operator

- Bio : Blanditiis perferendis voluptates quae adipisci ratione deleniti quas. Vitae sed cumque consequatur alias. Rerum nihil suscipit voluptates in ducimus in.

Socials

twitter:

- url : https://twitter.com/reina_rodriguez

- username : reina_rodriguez

- bio : Totam magni quibusdam rerum impedit corrupti alias. Molestias at harum ex earum sapiente. Voluptate explicabo et perspiciatis.

- followers : 285

- following : 280

instagram:

- url : https://instagram.com/reina_id

- username : reina_id

- bio : Non sit molestiae quam. Perspiciatis repellat qui repellat iste non.

- followers : 1261

- following : 1272